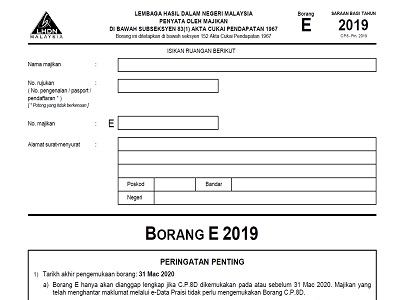

A on or before the due date - An increase in tax of 10 under subsection 1033 of ITA 1967 shall be imposed. 1 Due date to furnish this form.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

1 August 2018 3.

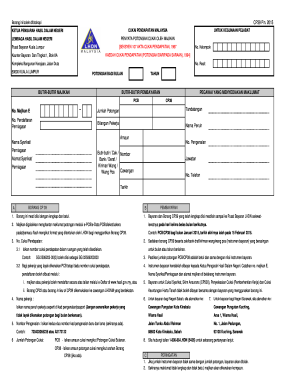

. Monthly contribution form or form 8a in its physical form to employers beginning. Jikalau tidak anda akan dikenakan caj tambahan dan penalti. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022.

Tarikh mula isi e filing 2022. April 30 for manual submission. TN By Hand-delivery None D Petroleum ITRF 1.

2 Pastikan anda bayar sebelum dari tarikh yang tersenarai di bawah. Lhdn b form 2021 due date. TR Via Postal Delivery 3 working days 7.

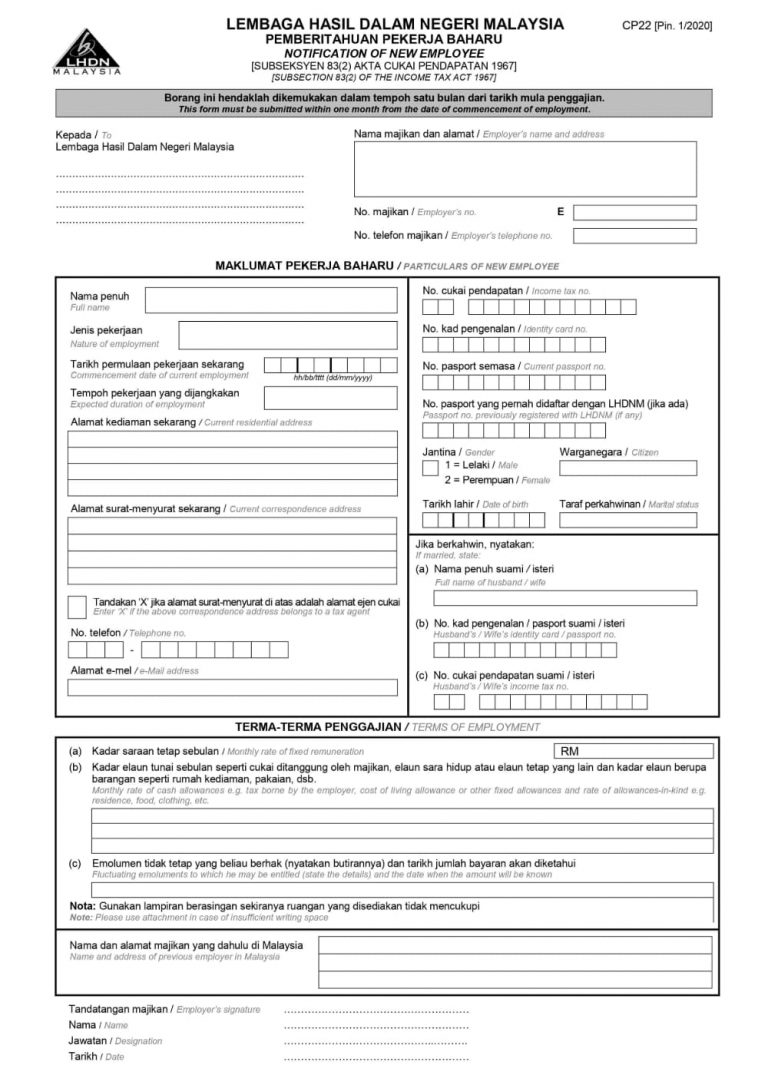

PT e-PT 1 July 2018 4. Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022. The deadline for BE is April 30.

30042022 15052022 for e-filing 5. Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2019 adalah menjadi satu kesalahan di bawah.

BR1M to continue focus on strengthening the economy. The form known as borang kwsp 17a khas 2020 is now available for download on the epf. The deadline for filing tax returns in Malaysia has always been.

1 Tarikh akhir pengemukaan borang. Kqr lhdn efiling_borang_b ver 13. Income tax return for individual with business.

One Borang E-ready software you can consider from the list is Talenox. May 15 for electronic filing ie. Talenox is a self-service HR SaaS that helps thousands of companies avoid penalisations and audits by.

31 March 2019 a Form E will only be considered complete if CP8D is submitted on or before 31 March 2019. The deadline for submitting Form E is March 31. B within 60 days from the due date - A further increase in tax of 5 under.

TC e-TC 1 July 2018 6. Workers or employers can report their income in 2020 from March 1 2021. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022.

Death certificate of the deceased. Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran. Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D.

All companies must file Borang E. Many of the Income Tax related forms are quite difficult to find. 30 June 2020 Do not carry on business.

Registration contibution2 form benefits appellate form borang SIP2017 PrintEmail. Income tax return for individual who only received employment income. Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE tahun taksiran.

Basically it is a tax return form informing the irb lhdn of the list of employee income information and. 31 Mac 2019 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2019. The due date for submission of the REITs.

The due date for submission of Form BE for Year of Assessment 2019 is 30 April 2020. Form e borang e is a form that an employer must complete and submit to the internal revenue board of malaysia ibrm or lembaga hasil dalam negeri lhdn. TA e-TA 1 August 2018 5.

Employers who have e-Data Praisi need not.

Payroll Borang E Form 2 Otosection

How To Prepare Ea Form Otosection

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Cp39 Login Fill Out And Sign Printable Pdf Template Signnow

Tweets With Replies By Sinar Project Sinarproject Twitter

Max Co Chartered Accountants Posts Facebook

Payroll Borang E Form 2 Otosection